Australian consumers are still obsessed with the live music experience, according to Pollstar’s Australian and New Zealand Spotlight, launched globally at BIGSOUND Brisbane this week.

The top five best performers in the Top 30 Promoters list – Live Nation, TEG Group, Frontier Touring, Destroy All Lines and Untitled Group – shifted close to seven million tickets and generated revenue of US$700 million in a financial year.

The top ten was made up of MG Live, Handsome Tours, Bluesfest Touring, the comedy focused Bohm Presents and the Chinatown Cinema Corporation.

The best selling tour here was Coldplay, who drew 723,271 fans and took home $85,974,148.

The top five tours were rounded off by Luke Combs at second spot with near 350,000 sales and close to a $49 million turnover. He was the first country music star to sell out a stadium tour in this country.

Pearl Jam were third on the list, with a gross of $42.3 million from 314,095 tickets.

Travis Scott turned over $32.2 million courtesy 278,662 fans while ticket sales of 211,062 for The Weeknd saw him boost his bank balance by $26.1 million.

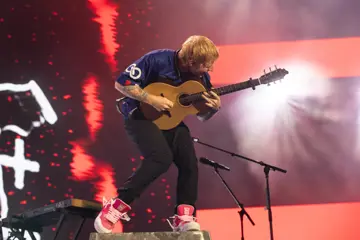

As it is, the sector has already had Pink and Ed Sheeran selling one million tickets in a single tour.

But what is impressing major local promoters is the speed with which artists are leaping to larger-capacity venues to keep up with demand.

Live Nation’s Michael Coppel told Pollstar, “They're going straight to arenas doing multiple shows on their first tours. It took Pink five tours to get from arenas to stadiums.”

Don't miss a beat with our FREE daily newsletter

Dion Brant, CEO of Frontier Touring added, “We consistently had artists who were at 1,000-cap when we were putting offers to them. By the time we were ready to announce, they were at the 2,000 or 2,500 range.

“By the time they got here, we were upgrading them to (7,500) arenas. It’s incredible to see.”

Ticket Prices

But another significant shift, noted TEG’s Global Head Of Touring Tim McGregor, is “We have seen significantly the breakthrough of the $100 psychological dollar barrier for emerging artists coming into Australia. Now it’s gone to $150 or $180.”

Chris O’Brien, GM of Destroy All Lines, pointed out that it pre-empts any consumer complaints about rising ticket prices by conveying through its marketing and social channels that it needs to absorb every rising cost.

“It’s good to have the conversation with them that everything in production – including staging, backline, lights, accommodation, insurance – have gone through the roof.”

For Nicholas Greco, co-founder and Managing Partner at Untitled Group, the fast rise is particularly acute for EDM artists and pinpointed Dom Dolla’s rapid rise to stadium level.

Greco said that part of the company’s own rise in recent years has been due to its database of 1.2 million, many of them aged 18—24.

“Gen Z has always been a strong part of our audience, but the connection has definitely deepened in recent years. We’ve ended up with what I’d say is one of the strongest and most genuine relationships with young audiences in the Australian music space.”

Ticket prices were also addressed this week in Tixel and Bolster’s Behind The Ticket – State of Play 2025 report.

79% agreed or strongly agreed with the cost of living’s “significant impact” on daily expenses. 57% had in the past 12 months had to decide between attending live events and basic living expenses. But 60% are spending more money on event tickets than last year.

The report quoted Jaddan Comerford of UNIFIED: “We’re seeing a bit of a ‘fuck it’ kind of energy. People want to enjoy their life, do great things, and go and see great live music.”

Customers were understandably upset at ticket prices being higher than expected. Sally Mather, Programming & Commercial Director at Forum Melbourne, warned prices were important. Even a $5 difference can make or break momentum.

But 72% would nevertheless fork out for a fave act. The delay in buying a ticket depends heavily on companions dragging their feet.

As with earlier Tixel/Bolster studies, and by others, there’s a wide gap between what music fans think of Australian content, and what’s really in play when it comes to support.

82% told Behind The Ticket they supposed initiatives which supported Australian support acts, like Michael’s Rule which demands equal promotion and stage space at international concerts. But the spend on global acts is more than on local ones.

Venues

The buoyancy of the live sector as described by Pollstar also seeped through to most tiers of venues, although grassroots spaces are of course still doing it tough.

“International acts are finding their way down here in record numbers,” remarked Scott Fitzgerald, General Manager of Marvel Stadium.

“People will go without things [in order] to spend on entertainment.”

Meagan Walker, stadium and venue operator ASM Global Group Director Of Arena Operations, confirmed all its venues in Australia broke attendance records in their last financial year. “We’ve had two fantastic years,” she said.

Marvel was the top performing stadium, reporting $91.4 million of revenue from 720,629 patrons. Second was Sydney’s Accor Stadium with close to $70 million and generated 582,187.

The Arenas list had Sydney’s Qudos Bank Arena at peak position grossing $114.1 million (1,064,383 patrons) at the top, followed by Brisbane Entertainment Centre grossing $50 million (545,743 attendees).

Melbourne’s Sidney Myer Music Bowl ruled the Amphitheatres column with events drawing 254,637 (gross: $19.6 million), trumping the Brisbane Riverstage’s 85,797 crowd draw (gross: $5.96 million).

The theatre with an attendance of 120,513 was the ICC Sydney Theatre (gross: $9.57 million) with PICA Melbourne putting 91,291 through the digital turnstyle (gross: $5.75 million).

Topping the Clubs list were the Forum and 170 Russell, both in Melbourne, and reflecting its reputation as Australia’s live capital. The Forum sold 181,762 tickets (gross: $9 million and 170 Russell clicked 83,541 times (gross: over $3 million).

The companies at the top of separate lists had the networks, technological suss and strategic partnerships to influence the operations of artist management, booking agencies, influencer attitudes and event marketing down the pyramid.

Going Global

Reaching out to its global readership, the Australian and New Zealand Spotlight included profiles on country music’s entry into a $1 billion value with a live audience of 3.26 million, and Perth providing a source of global music with a reputation as “the new Seattle” due to its remoteness from trends, a wide selection of venues, and a state government that wanted to make it the events capital of the Asia Pacific.

A profile of Live Nation’s Coppel saw him unveil how the company had grown to the top locally and plans for growth, New Zealand promoters were honest about surviving escalating costs, and there was a look at the recent impetus to export the music.

The prestigious Impact List included TEG’s Tim McGregor, Destroy All Lines’ Chris O’Brien’s, Untitled’s Nicholas Greco, Legends ASM Global Asia Pacific’s Harvey Lister, Live Nation ANZ’s Alex Klos, VenuesWest’s David Etherton, Bluesfest Group’s Barbara Maguire, architectural and venue designer Populous’ Chris Paterson, Tixel’s Zac Leigh and Ticketmaster Asia Pacific’s Kane Kete.

The global industry was also introduced to the NextGen of rising executives to watch who were aged 30 or less.

They were Proxy Agency’s agent Gabby Bortolot, Qudos Bank Arena marketing executive Brieahna Chadevski, Handsome Tours’ Project Manager for International Concerts & Touring Nic Tepper, VenuesWest Marketing Manager Emily Jones and Palais Theatre Events Manager Judith Veith.