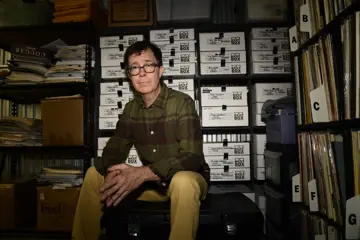

Melbourne based musical instrument industry entrepreneur Con Gallin's bid for the debt-ridden Australian Music Group has been knocked back, prompting him to lash out at the management and administration of the group which owns the Allans + Billy Hydes retail chain and wholesale arms Musiclink and Intermusic.

“It's real simple,” Gallin, who heads Australian Musical Imports, local distributors of Gibson guitars, as well as his own chain of retail stores Gallin's Musician's Pro Shop, told theMusic.com.au. “The people that run AMG, the management, which is Tim Mason and [former joint Managing Director] John Helme, they are not from our industry. They bought Allans thinking, nice business venture, knew nothing about the industry, were never musicians, didn't really understand the culture.”

Gallin said that the key point of the business is that, “Musicians work in the stores. You have musicians that work there and the customers are musicians. It's real simple. Now if you don't understand that culture and can't work within it and… you try and run it like a like a Bunnings or Myers or something else, it doesn't work in our industry.”

At the root of Gallin's angst is the fact that he originally tried to save the business by merging with AMG, and more recently offered to buy the entire group. Yet he claims has been knocked back several times due to unreasonable barriers the liquidators have put in his way. Once he became aware of the extent of AMG's woes, the merger was no longer an option but a takeover was still a possibility.

“We tried buying it [earlier this year] and Hilco, the liquidators, bought it through their British arm… Revere [Capital].”

Don't miss a beat with our FREE daily newsletter

Fairfax have reported that the National Australia Bank lost $48 million when they sold its debt from AMG, believed to be $56 million, to Hilco for just $8 million.

Following that failed attempt Gallin watched proceedings and waited for an opportunity to pounce again. That opportunity arose around six weeks ago.

“We made an offer for the whole lot, which was Musiclink, Allans + BIlly Hydes, Intermusic, and we offered more than double what we had offered earlier in the year. That was rejected. I said, 'What choice do you have now?' Earlier in the year there was no buyer anywhere in the world other than this liquidator who wanted to liquidate it, now you don't have a buyer anywhere in the world, let alone Australia. Nobody in Australia can raise this kind of money.

"Although they bought it for bugger all earlier in the year, [they said] they had a fixed inflating charge of three and a half times what they paid for it and unless we could come up with a ridiculous offer, we wouldn't buy it. So we upped the bid, then we upped it again and still it was not enough. I said, 'Well what have you got to sell? You have a broken down wreck losing money!' They said, 'We're going to liquidate it'.”

At that point America's Bain Capital, who were in Australia looking at another business takeover, along with US chain Guitar Centre got wind of what was going on and entered into the competition for AMG.

It is believed that many of the prize wholesale brands from Musiclink and Intermusic have already been lost to other local wholesale companies. As a result, Gallin is no longer interested in the wholesale side of AMG and is concentrating his focus on ten retail stores.

Discussions are believed to be ongoing.

Whatever the result, much of the press surrounding the collapse has blamed a poor retail environment and internet purchases, but Gallin argues that local retail is alive and well.

“Australia is the best country in the world. It has the lowest unemployment. Look what's happening in Europe. America's unemployment is seven or eight percent. China is now struggling. Everyone makes out all of a sudden that Australia has a retail problem because some of these clowns. The stock market is blood thirsty for profit. The stock market is not the place for a business like ours.”

He added, “There's an opportunity here to get this business like a really great music company where it is not vicious or aggressive and not money hungry. You promote bands, you endorse bands, you help bands.”

Reporting by Greg Phillips