Australia

AustraliaTikTok has 8.5 million users in Australia, spending an average of 29 hours: 36 minutes per month on the platform. It is the country’s seventh most used social media platform but more so with younger age groups.

The 18—24 year-olds make up 52 per cent while the 25—34 age group constitutes 33.7 per cent.

So no surprise, then, that Australia is one of the world’s markets where its Chinese owner ByteDance is trialling its latest moves to a music company.

When it launched its own TikTok Music streaming service in October, Australia was one of five countries to test it. The others were Mexico, Singapore, Brazil and Indonesia.

The company called it “a new kind of music service that combines the power of music discovery on TikTok with a music streaming service offering millions of tracks from thousands of artists.”

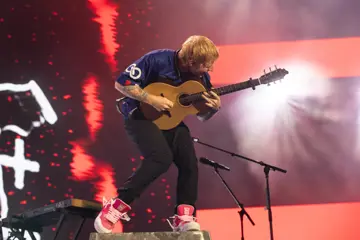

This week, as reported in TheMusic.com.au, it reaffirmed its place as a music discovery place when it expanded its feature where musicians could promote their shows and sell tickets directly in 21 new countries – Australia being one – after launching it in the United States last year.

Bigger Spend

Now research from US firm Luminate, commissioned by TikTok, showed just why the platform is confident of the spend and loyalty of its users.

The Music Impact Report looked primarily at the US, UK, Germany, Brazil and Indonesia in a 12-month window from July 1, 2022, to June 30, 2023.

Globally, TikTok customers spend significantly more across music-related categories compared to the average music listener across all markets analysed.

In the UK, they spend 49 per cent more on music purchases compared to average listeners. In the US, 38 per cent attended a live music event compared to 33 per cent on average, and 45 per cent purchased artist merchandise in contrast to 35 per cent.

Don't miss a beat with our FREE daily newsletter

In the US, 62 per cent of TikTokers (representing 93 million) pay for a music streaming service, compared to 43 per cent of all consumers. In the UK, it’s 85 per cent with a subs against 62 per cent of consumers.

It’s highest in Germany (91 per cent more likely), with 42 per cent more in Indonesia and 37 per cent plus in Brazil.

“In the global and US markets, TikTok user engagement metrics are strongly associated with streaming volumes. In other words, higher TikTok engagement — whether that’s likes, views or shares — corresponds with elevated streaming volumes,” Luminate said.

Among UK users, 45 per cent went to a concert compared to 35 per cent, Brazil was 59 per cent to 47 per cent. Those in Germany were 42 per cent to 30 per cent, and Indonesians 37 per cent to the average 29 per cent.

In other spends, German TikTokers were likely to spend 58 per cent more money on music festivals.

They were more partial to buying vinyl records: 15 per cent more in the US and 18 per cent in the UK.

As for music gift cards, Brazil’s spent nearly twice as much, and Indonesians were 37 per cent more.

Discovering Music

But the most significant finding was the role Tik Tok users play in finding new music and alerting friends in comparison to most social media and short video platform (SFV) users.

They were 102 per cent most likely in the UK, 96 per cent more in Germany and 71 per cent more in the US.

TikTok users are also more likely to discover new music via social media and SFVs themselves – 96 per cent more in Germany, 92 per cent more in the UK, 70 per cent more in the US, 28 per cent more in Brazil and 17 per cent more in Indonesia.

“In doing so, TikTok users help both emerging and established artists to reach new audiences,” the Luminate report stated.

They’re more adventurous, too, finding local artists singing in local dialects. In fact, TikTokers have been a major influence in how popular music is increasingly becoming less sung in the English language.

Research showed that 77 per cent of UK TikTokers want access to global music artists. In the US, 46 per cent want music that is not in English (33 per cent see this access as “extremely important”), which is 27 per cent more likely than listeners overall.

“In doing so, TikTok users help both emerging and established artists to reach new audiences,” Luminate stated.

Going Global

The study confirmed TikTok as a major driver of the globalisation of music – of local artists performing in local dialects.

Luminate summed up: “TikTok users have a stronger preference for international music than the average music listener. This preference, combined with the high volume of music discovery and sharing activity on TikTok, can be harnessed to grow a fanbase without borders.

“(It) has helped to launch global artists from genres such as Reggaeton, Afrobeats and K-Pop.”

It added: “TikTok users‘ interest in international music is evident in their music streaming preferences.

“Compared to the average music listener across each market, this audience is more likely to indicate that ‘access to music by global artists’ is an extremely important factor when selecting a music streaming service.”

This fits in with other reports that show that in Spotify, Italy and Poland artists dominate their respective singles and albums.

According to Luminate, English language music’s share of the Top 10,000 on-demand tracks on streaming services globally in the first half of 2023 fell to 56.4 per cent from 62.1 per cent in calendar year 2022 and 67.2 per cent in 2021.

English is dropping in markets as Portugal, South Africa, Indonesia, Colombia and Switzerland.

It explains why in May 2023, Spotify added eleven more languages for users, including Spanish for Argentina and Mexico, traditional Chinese for Hong Kong, and Arabic for Egypt, Saudi Arabia and Morocco.

That brought the total number of languages on Spotify to 74, from Afrikaans and Azerbaijani to Zulu, with Tamil, Bosnian, Filipino, Finnish, Greek, Urdu and Vietnamese in between.

“TikTok is already famous for being the launchpad for creating viral hits and breaking new artists, but we wanted to understand how TikTok and its users impact the music industry more broadly,” Ole Obermann, TikTok’s Global Head of Music remarked.

“Luminate’s findings prove what we had long known: that TikTok is the driving force behind music discovery in the industry and that TikTok users are active, engaged and highly valuable drivers of music industry revenues.”