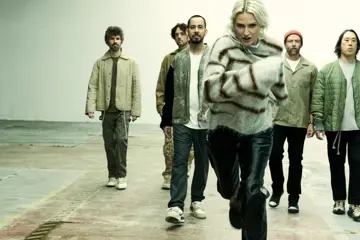

Wolf Alice

Wolf AliceThe British Phonographic Industry (BPI), the country’s recorded music industry group, reported that Australia remained the fourth largest export market for UK music for another year.

Australian consumption of UK music rose 3.4 per cent year on year to £32.7 million (AU $63.6 million) in 2023. It’s been steadily rising in recent years. In 2021 it increased its export value by 8.5 per cent to £26.7 million ($51.9 million).

The US remains the largest consumer of UK music, up 8.3 per cent to £320.9 million ($624.4 million). Germany followed with £63 million ($122.6 million) after a 6.7 per cent increase, and France up 2.4 per cent to £44.1 million ($85.8 million).

In fifth place, after Australia, was Canada which increased its consumption by 6.7 per cent to £28.2 million ($54.8 million). In sixth place, the Netherlands was responsible for £24.1 million ($46.9 million), up 5.9 per cent.

Don't miss a beat with our FREE daily newsletter

Rounding it off were Japan in seventh place, up 8.2 per cent to £22.6 million ($43.9 million); Italy down 3.7 per cent to £17.5 million ($34 million); and Spain up 7.3 per cent to £14.3 million ($27.8 million). China with the biggest jump of 11.3 per cent to £13.6 million ($26.4 million), replacing Sweden.

The BPI reported that in 2023, UK music exports hit a record high of £775 million ($1.5 billion), an increase of 7.6 per cent from 2022.

British acts continued to storm music in 2023. In Australia alone, seven reached Number One on the ARIA Charts. Sam Smith, Dave and Central Cee with singles and albums by Ed Sheeran, The Rolling Stones, Niall Horan and Lewis Capaldi.

Harry Styles’ Harry’s House set a new record in Australia when the entire tracklist charted within the top 15, going on to be certified double platinum.

Tour Grosses

Paul McCartney sold 220,471 tickets on his Australian tour, grossing US$37.5 million. Coldplay had by mid-year shifted almost 125,000. Sam Smith did 82,000 and Niall Horan clocked up almost 60,000 sales.

Sheeran set a new record at the Melbourne Cricket Ground with 215,000 fans, later shifting over 1 million by the end of the national dates.

But it wasn’t just the superstars. In 12 months, around 500 UK artists each accumulated over 100 million audio streams. These included names such as Wolf Alice, beabadoobee, Dave and Bicep.

UK artists now account for nearly 10 per cent of music streaming worldwide. That’s impressive coming from a country whose population only makes up 1 per cent of the globe.

Concern

However, the BPI expressed concern that despite the uplifting figures, there were issues. For starters, UK artists accounted for 17 per cent of global music streaming in 2015.

Part of this is due to strong competition from Latin America, Africa and South Korea as Latin, Afrobeat and K-Pop make greater international waves than before. Streaming has seen a surge in non-English language music, affecting the popularity of music from Britain, the US and Canada, reported research firm Luminate.

"It is encouraging to see British recorded music continuing to perform strongly on the world stage, but we can and must do even better in the face of fierce global competition as rival markets grow at pace,” said BPI CEO Dr Jo Twist OBE.

“If we are to maintain our proud record as a music superpower, UK music needs government backing and a supportive policy environment which encourages investment in talent-led growth and keeps human artistry at the heart of the creative process."

Twist said that many music scenes were growing—including in Australia—because their governments were investing in them. He said the rise in overseas revenue put the UK on track to deliver BPI’s aim to hit £1 billion ($1.94 billion) in annual UK recorded music exports by 2030.

Investing In Export

But to achieve this, in the face of global competition, the UK industry argued it needed to have a government policy that encouraged record label investment in talent.

A dozen acts that have generated global followings—such as the above-mentioned Beabadoobee, Dave, Bicep, and Wolf Alice—were fostered by the BPI’s government-funded Music Export Growth Scheme (MEGS).

It has been successful, finding success with 350 acts and with a 14-1 return on the investment. The Government recently upped its funding by a further £3.2 million ($6.2 million) over the next two years.

Among other ideas pitched by the music industry to the British Government have been:

A tax credit to encourage new investment in music, similar to what the film, TV and video games sectors get.

Create a well-funded music export office similar to those in Australia, Germany and Canada. This would increase the acts’ export profiles, address export barriers and make music a flagship export industry

Increase funding for Arts Council England (ACE) to invest in wider music projects, including indie labels, charities, promoters and education.

Secure a Cultural Touring Agreement with the EU as part of the 2026 Trade and Cooperation Agreement (TCA) review. In 2019, the EU was the UK’s largest live music market, worth four times the size of the US, its second-largest market.

But increased bureaucracy for touring musicians after the UK exited the EU has created issues with restrictive visas, work permits and more red tape regarding truck hire and selling merchandise.

Reduce the VAT (or GST) on concert tickets to 10 per cent from 20 per cent. This would put it on equal footing with EU markets as Belgium (6 per cent) and Germany (7 per cent), which in turn would incentivise the country’s grassroots scene and local economies.

The impact on local UK economies by major tours came into the spotlight after the mid-year announcement of Oasis dates, said to be 1.4 million tickets for 17 shows. The dates are set to have a multi-million dollar boost to local economies in terms of accommodation, dining, businesses and entertainment.

The retail sector also gets a splurge. The HMV chain already reported a 526 per cent jump in vinyl sales of the band’s back catalogue after the reunion announcement, while ‘90s nostalgia is expected to hit fashion sales over the next two years. The buzz is that the worldwide tour will exceed what Oasis achieved in the past with record sales and concerts.

The trade body UK Music’s Chief Executive Tom Kiehl said the gigs have a large economic potential. “Having a big music event in your community has a knock-on and spill-over impact on the wider economy, too, so [that is] great news for the UK.”

Research by UK Music found that 19.2 million music tourists attended live shows in the UK in 2023, an increase of 33 per cent on 2022 when the figure was 14.4 million, which helped to generate £8 billion ($15.5 billion) in spending.

Foreign Revenue

Foreign revenue is important, of course, especially for medium- to small-range acts. Research from UK Music found that British musicians who earn £200,000 ($389,225) get 69 per cent of their earnings from outside their home country.

Broken down, this is 30 per cent from the European Union, 30 per cent from the rest of the world, and 40 per cent from the UK.

A report from the Musicians Census of almost 6,000 music industry professionals found that most (25 per cent) of British musicians are aged 25 to 34. A close run with 24 per cent is the 35—44 group.

The 45—54 demo only makes up 20 per cent, the 55—64 group is 16 per cent, the 17—24 a low 8 per cent, and the 65 to 74 group is 5 per cent. In case you were wondering, Paul McCartney is the UK’s richest musician, with an estimated fortune of £865 million ($1.66 billion). Harry Styles tops musicians aged under 30, with an estimated £100 million ($194.6 million).

Next Report

What will BPI’s next report covering 2024 look like? Coldplay, for instance, continues to smash records on its global trek. The band’s tour is tipped to sail past the 10 million ticket mark by the time it ends and is expected to have already reached US $1 billion by mid-2024.

Charli XCX’s Brat continues to perform well beyond expectations. In Australia, for instance, its remix with 20 acts went to Number One this week from Number 16, after peaking at Number 3 earlier this year.

Will Australia retain its Number 4 position in years? It seems other territories are coming to the fore with huge jump. The BPI report noted that the growth of UK music was in all territories, with double digit do increases of 26.3 per cent in India, 17.3 per cent in Latin America, and 11.1 per cent in Africa, 9.9 per cent in Asia and 9.5 per cent in the Middle East.

It’ll be interesting to see what transpires.