TikTok

TikTokThis month, for the third time in 2024, indie artists are caught in the crossfire as TikTok battles with the music industry.

If things are not resolved by October 31, indie tracks will start being dropped from one of the most influential platforms for music discovery.

The latest knuckles-up is with Merlin, the global indie licensing body. It comes as new data shows that more indie musicians than ever are shifting to TikTok and other social media because they believe they push their careers further than labels and streaming services.

Ironically, some indie creatives are accused of dubious practices that are causing this rift.

Merlin represents 30,000 labels and copyright holders through deals with 500 labels and distributors. That’s a 15 per cent global digital music market share, which it says is equal to Warner Music Group’s.

Early in the month, TikTok cut licensing negotiations with Merlin, wanting direct deals with individual indies. It says it’s necessary to combat streaming fraud. Indies, on the other hand, argue it’s really all about TikTok trying to pay the sector less.

Don't miss a beat with our FREE daily newsletter

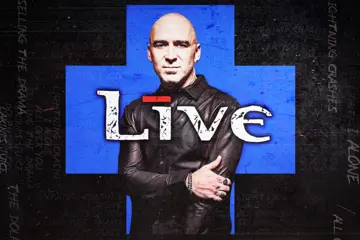

After October 31, tracks by Nirvana, Phoebe Bridgers, Diplo, The Lumineers, Mac Demarco, Madlib, Mitski, Thundercat, Wet Leg and Coolio could start to be removed from TikTok.

Fair Value

Earlier, on February 1, Universal Music Group (UMG) announced negotiations over TikTok paying “fair value” for music, AI protections and on-app safety were at a standstill.

Initially the indie sector thought having UMG biggies like Drake, Taylor Swift and BTS going dark would give its acts more space.

To its horror, hundreds of indie tracks were also pulled if their labels were distantly distributed by UMG, a song was co-written with someone signed to UMG publishing, or some of their cover songs were UMG-associated.

The two made nice three months later. But it was a traumatic experience for musicians. “Some of us will not be able to recover from this,” said one at the time. Some admitted to “full-on panic attacks”. Others wished they’d signed straight to TikTok.

In April, the US-based National Music Publishers’ Association allowed its TikTok license, which was used by a number of smaller indie publishers, to lapse. It has not been renewed.

However, TikTok made direct deals with “thousands of music publishers—including NMPA members—to help make their songs available on TikTok.”

Music’s Role In TikTok Business

The collapse in negotiations between Merlin and TikTok raises a number of questions.

One is how big a role music plays in TikTok's business and how much they want to pay for it.

Data from 2023 showed 85 per cent of TikTok videos had music, with YouTube’s videos right behind at 84 per cent. Instagram had 58 per cent and Facebook with 49 per cent.

A quarter of DIY indie artists now put their music directly on TikTok and other social media, says an economic report from MIDiA Research.

The creatives are bypassing distributors and record labels. There’s even a shift from streaming services like Spotify and Apple Music.

MIDiA founder Mark Mulligan notes, “Creators are growing increasingly dissatisfied with music streaming services. Part of that dissatisfaction is, of course, how little services like Spotify pay artists per stream, but royalties aren’t actually their main issue anymore.”

He goes on to explain: “Their royalty expectations are already so low that this is no longer a pain point for them.

“Instead, they are becoming critical of streaming’s ability to further their careers, focusing on the medium’s closed door between them and their fans.

“Today’s creators want platforms where they can build high value, smaller fanbases, rather than low value, large-but-anonymous audiences.”

As a result of this shift in thinking, record labels have shrunk to be “the smallest segment of the music creator economy.” In the meantime, one of the biggest growths is DIY artist distribution on social media platforms.

TikTok’s celebrated importance to indie musicians is evident in the way it breaks acts and revives classic hits. But another key finding from MIDiA is that nearly half of those who put out music in 2023 only began during the COVID lockdown.

These creators and their fans were bored and super-hungry for new content. Other formats could take ages to release new works. TikTok merely meant hitting “Post.” It allowed them to communicate more effectively with their fans.

Mulligan points out, “There aren’t many places better for high-value fanbase cultivation than platforms like TikTok (and YouTube and Twitch, both of which have also seen surges in content from musicians).

“The fact that musicians know this means we could see a lot more indie hits get their start on the platform.”

He concludes: “The question is, will we see record labels, distributors, and streaming services shift their business models in an effort to try to lure these DIY-savvy creators back to more traditional means of music publishing?

“And, by that point, will music creators even want to go back?”

Condemnation

Condemnation from the global independent sector came quickly from trade associations such as AIM, Impala, the Association of Independent Music, and the Independent publishers body IMPF.

TikTok was blasted as “disrespectful” and adopting a divide-and-conquer strategy to force individual labels into less favourable deals. Some called for their governments to step in.

“Like a supermarket chain negotiating directly with individual farmers for the price of their milk, it’s difficult to see how this can work out in the farmers’ favour,” Impala stated.

The important thing about Merlin is its collective clout. Until it came along, indies around the world didn’t have a wide global footprint to strike effective game-changing digital deals.

Plus, the landscape was constantly changing and they needed Merlin’s expertise to do the negotiating.

Its members include 4AD, Australia’s Mushroom Group, Epitaph, Naïve, [PIAS], Domino, Tommy Boy, One Little Indian, !K7, Matador, Sub Pop, Partisan, Warp, XL Recordings, Koch/E1 and Secretly Group. It has close ties to Australia via the Australian Independent Record Labels Association (AIR).

In its first year, Merlin struck deals with nearly 40 digital services and distributed over US$2 billion to members. It financed initiatives such as mentoring 30 female executives to become indie sector leaders. More recent triumphs included remarkable pacts with China and Facebook, which would not have happened without its sway.

Along with striking digital deals for indie labels on TikTok, Merlin also licenses members’ catalogues to 40 services, including YouTube, Meta, Spotify, Apple Music, Amazon Music, Tidal, SoundCloud and Deezer.

Dodgy Practices

But analysts agree that TikTok has a point when it accused Merlin-partnered independent artists and labels of dodgy practices.

For two years, the platform has warned Merlin several times about instances where artists have uploaded slowed-down or sped-up existing tracks that were copyrighted to TikTok and claimed royalties on them.

In early 2024, TikTok sent Merlin an itemised list of over 1,000 such tracks. Half of these were uploaded by DJs, who had generated 1 billion plays on TikTok over a six-month period. Such accusations were painful for Merlin because it has been vocal about streaming fraud.

Earlier this year it was reported TikTok generated $120 billion globally in 2023, a growth of 40 per cent from the year before. But its costs were massive. In the UK alone, cost of sales were up 85.6 per cent to $3.38 billion, administration expenses tripled to $1.57 billion, and staffing costs up 22 per cent to 805 million.

Globally it spent $1 billion on legal fees, including battling the US Government’s insistence it sell to a non-Chinese owner if it wants to continue operating in America, or a $370 million fine in 2023 for violating European Union laws on the protection of children’s data.

Flexing Its Muscle?

To what extent is the Beijing-based company flexing its muscle? This year, it was revealed that it has a global audience of 1.56 billion. It’s almost up to Instagram’s 1.65 billion.

Revenue-wise, it’s fast catching up to Meta’s $131 billion. The difference was that while TikTok was growing at a rate of 40 per cent, Meta grew at 16 per cent.

America provided $16 billion worth of revenue. The UK turned over $4.57 billion. In Australia, where it has 8.5 million users, profit doubled to AU$11.4 million and revenue doubled to $375 million.

Music Plan

The Merlin issue also has the global music industry wondering about TikTok’s music plans. The company has already declared its aim to “become the most influential music platform for the next generation of music enthusiasts to express themselves and connect.”

It seems to be shifting away from music streaming to focus on its ‘Add To Music’ feature.

It allows users to save songs they discover on TikTok directly to streaming services such as Spotify, Amazon Music and Apple Music.

It launched in the US and UK in November 2023 and, in the following months, was in 182 other territories. According to its Global Head of Music Partnership Development, Michael Kümmerle, “We have seen the TikTok community fully embrace (this) opportunity.”

On November 28, its streaming service TikTok Music will shut down in less than a year in the five regions where it operates (Australia, Indonesia, Brazil, Singapore, and Mexico).

Rival streaming services in the five countries will obviously welcome the news. But Deutsche Bank research calls it, above all, “a clear positive for Spotify.”

Both TikTok Music and Spotify appealed to a similar young age group. TikTok Music is estimated to have between 2 million and 2.5 million subscribers. Of these, Deutsche Bank forecasts that at least 1.3 million will head to Spotify.

Deutsche Bank’s report suggests TikTok Music’s lack of a free tier contributed to its downfall. “Without an ad-supported tier acting as a funnel for new users, TikTok Music failed to gain traction in many of its markets,” it says.

It’s moving from licensing to buying up its own rights. It has formed a Music Content Investment Team with a global focus. It can prioritise these rights in the algorithm for its users and create a very healthy revenue stream.

Earlier this year, TikTok also conducted tests in Australia by restricting some users’ access to major label hits. The idea was to see if the popular app could survive relying on major label content. Research firm Data.ai showed the results were mixed.

Among its patent protection applications in the US is for an invention that enhances music play on electronic devices music experience, allowing greater engagement with visual effects such as flashing lights and screen effects and haptic feedback like vibrating to the rhythm, all synchronized with the music.

This would allow TikTok to strike new partnerships and open up new revenue streams. It could also be a device that TikTok could start selling directly to consumers.

Music Business Weekly figured one way to detect TikTok’s future direction would be to look at its research by parent ByteDance’s Speech, Audio & Music Intelligence (SAMI) team, which has been busily exploring the field of AI music.

Its US patents are filed by a mysterious affiliate, Lemon Inc. One feature automatically creates a video when a piece of music is created which “may be royalty-free and can be of any length.”

Another is a sophisticated version of software where music is created around a set of lyrics that is input. The idea was tried elsewhere, but Lemon said the results were “scattered or disjointed organization and song structure, mismatched rhythm and lack of a catchy repeating melody.”

Mawf is a machine-learning-driven music-making app that analyses incoming audio signals and then “re-renders” those signals using what it says is machine-learned models of musical instruments.”

MBW previously mooted if TikTok can pull off a “heist” on the music industry through its aggressive investment in generative AI technology.

“Using licensed music as a cornerstone in the rise of TikTok to well over a billion users globally, before using first-party, AI-created songs to crowd out music owned by traditional music rightsholders on the platform.

“With music playing such a key role in TikTok’s rise, if major label content does disappear from the platform – and the gap is somehow successfully filled by indie and AI-driven creations – TikTok could be said to have pulled off one of the biggest heists in music business history. A bait and switch for a billion users.”