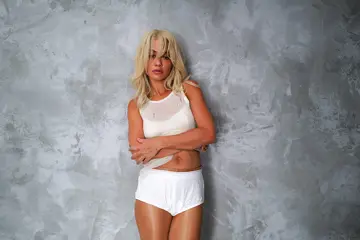

Kylie Minogue

Kylie MinogueAustralian acts were the eighth most-streamed artists in the first quarter of 2025.

They were outranked by those from the US, UK, Canada, South Korea, Germany, France and Puerto Rico.

This is according to the latest data from US-based research company Luminate’s Export Power Score, which evaluates a country’s ability to export music globally.

A 2024 Luminate report noted that music from the US made up 61.2 per cent of the top 10,000 artists’ streaming share in Australia, followed by the UK at 16.6 per cent.

Australian acts, at third spot, only made up 9.2 per cent, then Canada (5 per cent), India (1.7 per cent) and South Korea (1.5 per cent).

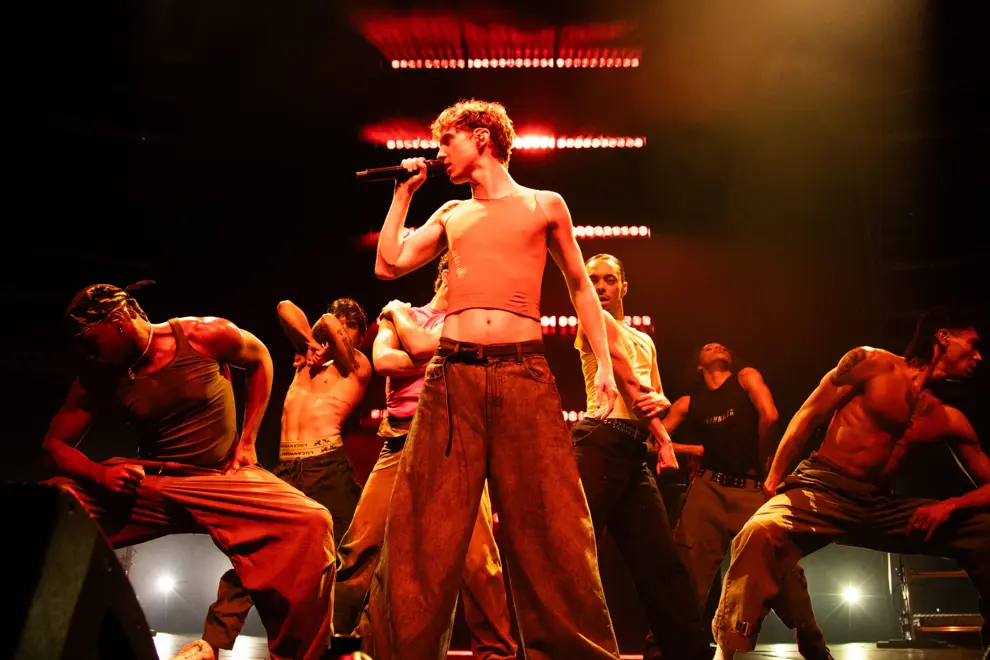

This year, the most stream-bombing Aussies are on world tours or spotlighted for other reasons.

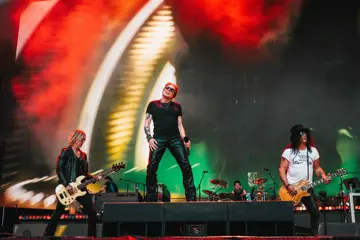

These include AC/DC, Keith Urban, Kylie Minogue, RÜFÜS DU SOL, Tame Impala, Troye Sivan, Royel Otis, Dom Dolla and FISHER.

Others also ranking high on streaming services include The Kid LAROI, Sia, Vance Joy, Dean Lewis, Lithe, 5SOS and CYRIL.

On the other side of the credit card, Australian music fans consumed most from the US, UK and newcomer, the Philippines, in the Top 3. That spot was previously occupied by Germany.

The Philippines, Argentina and Norway are among the new markets marking their presence in the export successes of other countries in Luminate’s Top 10. These follow big growth in recent years by Mexico, Brazil and India.

“The international music trade is no longer just about the very top exporters — it's a vibrant, shifting network of global tastes and regional momentum,” notes Luminate.

It goes on to say: “The Philippines appears as a new top 3 importer of Australian music, signalling growing cultural and streaming ties in Southeast Asia.”

The Philippines

Don't miss a beat with our FREE daily newsletter

The Philippines is among the biggest world markets for the likes of AC/DC, Kid LAROI and Chase Atlantic, says Spotify. The country is also a major market for the band Sheppard, according to Chugg Music.

74 per cent of streamers in the Philippines make their discovery on social media, with the biggest growth of 88 per cent being among Millennials.

Also massive is the Hindley Street Country Club (HSCC) from Adelaide, which markets itself as “The Greatest Cover Band in the World.”

Its stylised repertoire of hits from the ‘70s and ‘80s struck such a chord that it is its second biggest market (13 per cent, with the US out front at 18 per cent) for social media and streaming.

Last September, its first visit there saw it sell out the 2,325-seat New Frontier Theatre, marking their first overseas headline show. Band leader Constantine Delo remembered it to TheMusic.com.au as “so emotional, there was so much love coming from the audience.”

It’s also a considerable market for singer-songwriter Ruel, who gets mobbed at airports and sells out shows to screaming fans. Ruel plans to work with local acts.

Melbourne-based singer-songwriter Keenan Te, who got 70 million streams globally for his Dependent single, visited there four times by last year and continually tops local Spotify charts.

He recorded with emerging singer-songwriter Maki and plans to work with folk-pop collective Ben&Ben and P-pop girl group Bini.

Asian-Australian hip hop acts, such as Brisbane-based Elcid Flores, also have their followings there. Growing up in a Filipino household, he says, "Filipinos by design and culture, I guess, are very, very musical — I grew up singing karaoke every single day,"

Sydney-raised Grentperez, of Filipino descent, started creating a buzz worldwide since the age of 12 uploading covers on to YouTube. Now he posts photos from his North American tour and sets to go back on the road in Australia in spring.

Export Value

Six years ago, the Born Global: Australian Music Exports report estimated the export value of the Australian music industry at $195 million. This combined the export income of artists, music publishers and record labels.

Born Global was research conducted over three years by the University of Newcastle and Monash University, in partnership with Sounds Australia, APRA AMCOS and the Australia Council for the Arts.

"Australian music has always punched above its weight on an international stage," said lead researcher Professor Richard Vella from the University of Newcastle.

Global music streaming reached a new high in 2024 with on-demand audio (ODA) streams reaching 4.8 trillion, up year-on-year by 14 per cent, and worth US$20.4 billion (AU $31.5 billion).

By the end of 2025, it is forecast to be $35.45 billion (AU $54.79 billion). Much of that revenue will be generated in the US, amounting to $13.91 billion (AU $21.50 billion).

By 2029, there’ll be 1.2 billion users worldwide, fuelled by high smartphone and internet penetration, greater features interaction between social media and streaming, and more platforms using advanced technologies like AI and analytics for a greater user experience.

As far as Australian acts are concerned, streaming seems to be the best way to break into the US market.

It’s become harder since 2024, with a 250 per cent spike in visa fees. Mid-tier five-piece bands, for instance, report paying $20,000 (AU $30,923) in fees and administration to travel to the US.

But all indications of growth in this country seem positive.

Smartphone

The smartphone penetration rate is expected to reach 87 per cent by 2026, pushed along by the shutdown of 3G networks across the country.

Internet penetration stands at 97.1 per cent of the population, with 256,000 coming on board between January 2024 and January 2025.

Born Global made the point that gigs and touring were where Australian acts made their most international money.

Overseas royalties to Australian artists doubled from $21.6 million to $43.7 million between 2013 to 2018. The number of international performances has also grown, from 2,845 to 7,095 between 2012 and 2017.

The return of Labor with such a large majority gives all the indications that it will be more open to factors the music industry is calling for.

As reported in TheMusic.com.au, these include more export dollars and quotas for streaming playlists and radio airplay, which will provide a greater pool for acts ready to take on the world stage, and a revised look at breaking the music markets of the Indo-Pacific region.

As streaming playlists become more diverse stemming from new markets where English is not the first-language. On that front, Sounds Australia led, as part of the Government’s $30.9 million Live Music Australian budget package, lead trade missions to South America and Asia.

Government grants provide the largest source of export support for those making inroads abroad. Those with support from both government and industry reported the greatest export success.

Born Global made the point in 2019 that a small 10 per cent accounted for 97 per cent of total export income.

But that has changed since Tony Burke took over the Federal Arts & Music portfolio, with a focus on greater diversity and career paths.

Last February, Music Australia’s new Export Development Fund that provided the solution in a three-prong attack, with performance & touring, professional & artistic development, and audience and market development.

For the first time, Aussie creatives wanting to make waves internationally had the benefit of a scheme that simultaneously took in international festivals, elevated the number of headline tours, collaborations with international artists, awards nominations, radio airplay, and appearances on streaming and television platforms.

Director of Music Australia, Millie Millgate, a long-time pioneer of helping to break Aussie acts globally as head of Sounds Australia, said, “Australian artists and music businesses can rarely be sustained by a domestic market alone.

“Committing funds for export will crucially assist with long-term career sustainability and enable music businesses access to varied additional revenue streams across multiple territories, bolstering the overall economic performance of the sector.”

An analysis of music export development initiative by Get Law made the point: “The regulatory and legal framework governing Australia’s music export development initiatives is shaped by federal and state policies designed to support artists while ensuring compliance with international trade obligations.

“The Australian government provides guidelines on intellectual property rights, export funding eligibility, and industry standards to help local musicians expand into global markets.

“These regulations are intended to ensure that public funding for export initiatives is distributed fairly and used for genuine music export activities. Additionally, businesses and artists must comply with tax and financial reporting obligations when receiving government support.”

It stressed the importance of executives networking at global music conferences, festivals and trade fairs to establish relationships with international promoters, labels, and distributors.

“The economic impact of a strong music export sector extends beyond individual artists,” Get Law summed up.

“A thriving export industry contributes to job creation, supports local businesses, and generates significant revenue for Australia’s economy.

“When Australian music succeeds overseas, the benefits flow back to domestic recording studios, event organisers, marketing agencies, and other industry stakeholders. This strengthens the entire cultural and creative ecosystem.”