Blackpink

BlackpinkThe music industry has 4.2 billion reasons why it plans to focus more on superfans. Two recent studies, from US research company Luminate and financial giant Goldman Sachs, pinpoint their growing influence.

Luminate points out that superfans comprise 15 percent of the general population in America, but spend 80 percent more money on music each month than the average music listener. “The first half of 2023 is defined by more empowered superfans with a growing hunger to support their favourite artists,” said Luminate CEO Rob Jonas.

Goldman Sachs’ latest Music In The Air report, published June 29, categorised superfans as 20 percent of paid streaming subscribers today. 44 percent of them take out a streaming subscription only to support their heroes, and they are 128 percent more likely to buy music on physical formats (vinyl, CD, cassette). They’re also more likely to be Millennials or members of Gen Z.

Advertisers wanting to reach superfans are advised to hit social media, because that’s where those superfans go to be the first to know what’s happening.

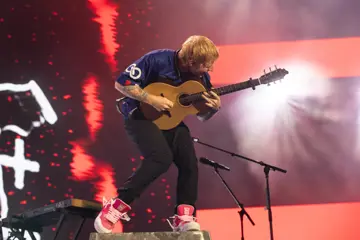

They’re event mad: 95 percent say they’ll buy tickets to another event within the next 12 months, compared to 75 percent of the general population. Brands are even told that the best time to reach superfans is immediately after a live music event. In the days after one, 63 percent of superfans are looking at social media for another live music event to attend, and 86 percent are talking about it with family and friends.

Red pencil through genres

Don't miss a beat with our FREE daily newsletter

Superfans cut a red pencil through all genres. Rap fans nickname them nigbeats and widdas as a mark of honour. Afropop and Afrobeats fans spend 121 percent more per month than the average US music listener. And the most ardent are K-poppers, who spend 75 percent more money on music per month.

It’s more than buying multiple copies of the same record, or snapping up every piece of merchandise an artist releases: some will hire a club for other superfans to meet, or spend thousands of dollars renting billboards wishing their idols a happy birthday. Superfans were even accused of “rigging” the charts for BLACKPINK, watching their videos ten times an hour to influence streaming numbers.

Brett Smith (a Senior Music Producer at SBS Music Channels in Australia) says, “They are super passionate and very loyal. They will raise money on behalf of their group and donate it to a charity. They will get their fan group together before a concert and make banners. They’ll do anything for their group. Their loyalty is next level!”

To reach the YouTube-obsessed fans, K-pop entertainment companies will often spend $1 million on a single video. “The visuals and the money that these entertainment companies put into their music videos is unbelievable,” Smith stresses. “K-pop set a new worldwide quality standard for music videos many years ago and most western artists still can’t come close to this in my opinion. “When the visuals are this good, no wonder why YouTube is the number one streaming service. It’s also free, which is a big benefit for a young audience!”

K-pop superfans are known as “saesungs”, which translated from Korean is “private life”. It alludes to the darkness of their obsession, which could include stalking and hacking into personal computers and digging up private dirt... An effort to feel closer to their idols, but one that really could kill careers off if any personal information was to be leaked. Some of this is low-level criminal activity, which faces fines of 100,000 won ($132 AUD). But acts’ managements never take legal action, lest they cause backlash from the fans.

A step further

Goldman Sachs take their estimate of superfans representing 20 percent of paid streaming subscribers a step further. If these superfans were willing to spend double, it implies there’s $4.2 billion remaining untapped, which the music industry could safely breathe on.

One way to tap the market further could be via the upcoming generation of artist- and fan-friendly music streaming services.

Sir Lucian Grainge, head of Universal Music Group, the world’s largest record company, has spearheaded the push for these. “Streaming has evolved in a way that undervalues the critical contributions of many an artist as well as the engagement of many fans,” he reckons.

Earlier this year, Universal signed with TIDAL and Deezer to develop a model. It’s too early to see how it would look exactly, but it would reward artists who bring more fans onboard and keep them there for longer. For Deezer CEO Jeronimo Folgueira, increasing fan experience would include superfan rewards, in-app live-streaming and VOD concerts, lyric translations and music quiz functionality.

Platforms such as California-based music streaming service Audius allow artists to connect more directly and deeper with superfans, exclusively offering rare tracks or the chance to remix songs. Audius says it has cracked eight million superfans thus far.

The music industry is increasingly taking tips from how aggressively the gaming industry pushes the envelope with monetising superfans. At the blink of an eye, gaming superstars will ask for donations, endorsements and direct subscriptions, charging fans to give them personal advice, remixes and virtual gifts.

A new scenario

With this kind of new thinking in the relationship between music acts and superfans, Goldman Sachs set a new scenario. If the trend of superfans paying double for their streaming service grows from 10 percent to 70 percent by 2030, when the industry is expected to be worth $150 billion, it could generate more than $4 billion in extra cash. “As a result,” the report states, “we believe there is a significant opportunity to better monetise artist superfans, which in the download era spent [three times] more on music than an average individual.”

Goldman Sachs believes that rather than limit the current break-up of streaming price tiers – basic, student, family and so on – there’d be more tiers within a premium range. “Beyond headline price increases, we believe that there is an opportunity for the industry to improve monetisation through a premium segmentation of their user base, which would better align monetisation with the value created by an artist or a song for the platforms,” says the report. “The current streaming model does not distinguish between its users, charging each the same flat monthly fee, independent of the level of engagement with the platform and its artists.”

Other takeaways

Other takeaways from Luminate’s mid-year report underline the rising importance of superfans as the music industry itself grows. For instance, globally, total on-demand song streams (audio and video) grew 30.8 percent in the first half of 2023 to reach 3.3 trillion, compared to 2.5 trillion on-demand song streams in the first half of 2022.

Total on-demand audio song streams rose 22.9 percent to two trillion. US on-demand audio streams reached 616.5 billion (up 13.5 percent), while song streams (audio and video) hit 713.5 billion after an expansion of 15 percent from 12 months before.

Total album consumption – including streams, downloads and digital and physical album sales – rose 13.4 percent to 538.9 million in the first half of 2023.

There are two trends among American fans, which may be reflected in Australia and elsewhere on the globe.

Firstly, there is a greater love for non-English language tracks, with the rise of Latino, K-pop, J-Pop, Afrobeat and Afropop. English-language music’s share of the Top 10,000 tracks on streaming services globally fell to 67.2 percent in 2021, then 62.1 percent in 2022, and now 56.4 percent in the first six months of 2023. Spanish language tracks made up 10.6 percent, while Hindi songs made up 8.7 percent, Korean songs accounted for 3.1 percent and Portuguese songs comprised 1.6 percent.

Secondly, according to Luminate, the amount of music audio files being added to music streaming services in the first quarter 2023 reached 120,000 a day.