The global music industry was in full growth mode last year, with rapid changes in how artists and fans interact, the impact of the Gen Z factor, and the emergence of a dozen buoyant new markets making their mark.

But Australians remained a relative global powerhouse as consumers and songwriters.

American and global data from US research and chart compiler Luminate’s 2024 Year-End Report last week showed that 4.8 trillion streams were generated around the world.

This set a new milestone, a 14 per cent boost from 2023, which also set a new record.

The US market’s streaming growth has matured and slowed down by 6.4 per cent. But this was outstripped by a 17.3 per cent uptick by the rest of the world.

“We saw some interesting trends within the US,” said Jaime Marconette, Luminate’s Vice President of Music Insights and Industry Relations, in the report launch webinar.

"Latin was the fastest-growing US streaming genre in the first half of the year based on growth of genre streaming share. However, due to a shift of streaming activity in the second half of the year, pop took the #1 spot.

Don't miss a beat with our FREE daily newsletter

“Female solo artists led this surge in pop consumption, as streams of their music were responsible for nearly two-thirds of all audio streams amongst the top 100 pop artists in the US.”

Taylor Swift dominated the proceedings, kicking open more doors for a new generation of female pop singers and marking pop as the fastest-growing genre of the year.

Shaboozey’s A Bar Song (Tipsy) was the most-streamed song of the year, with 912.7 million on-demand audio streams, generating $53.4 million.

Export

In terms of countries that exported their music globally, Australia was ranked at #8.

The list was topped in the US, with the UK at #2, then Canada, South Korea, Germany, France and Puerto Rico. After Australia, Sweden was at #9, and Brazil rounded off the Top 10 list.

Australian songwriters, too, pulled their weight, according to Luminate’s lookback window, with sixth-highest representations in the top 1,000 digital songs.

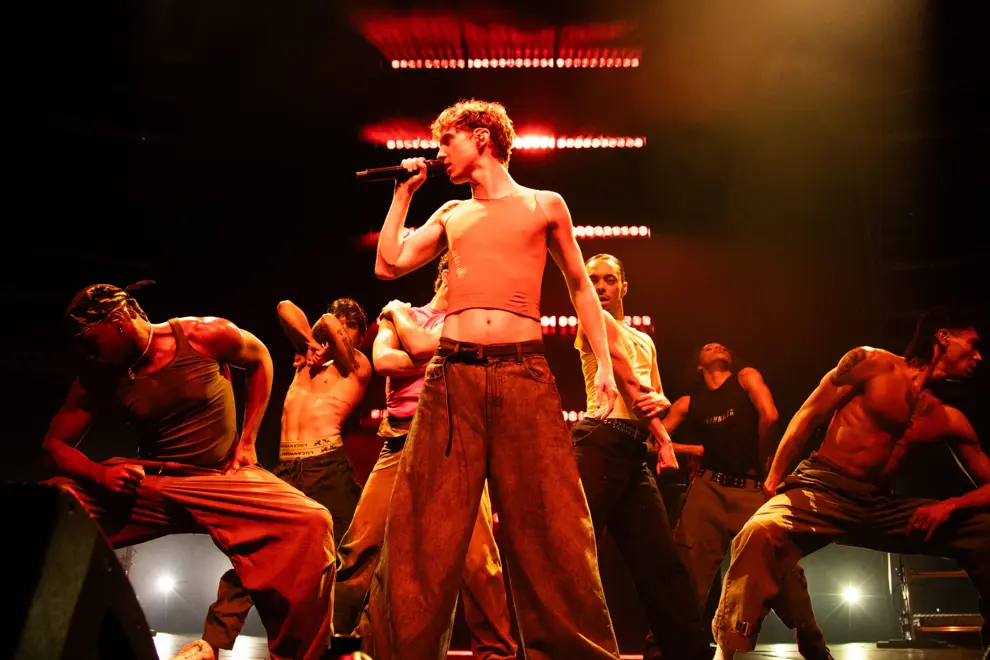

These would have included The Kid LAROI, Lithe, FISHER, Dom Dolla, Troye Sivan, Sia, Tame Impala, AC/DC, Tobias, 5 Seconds Of Summer, and Royel Otis.

Songwriters joining APRA AMCOS’ 1 Billion List last year were Timmy Trumpet feat. Savage’s Freaks, Perth hailed drummer/producer Paul Mabury for co-writing Lauren Daigle's You Say and Nick Littlemore, Jono Sloan and Luke Steele for Empire Of The Sun’s Walking On A Dream.

Luminate’s songwriter list saw the US, UK and Canada in the lead. Those from Sweden (primarily due to one-person hit factory Max Martin) and France at #4 and #5. Australia was followed by Norway, Germany, Colombia and South Korea.

Australian fans were among those responsible for the growth of the country and Christian/gospel genres.

Not only has Contemporary Music become diverse, but it has continued its thirst for new discovery. Songs released between 2020 and 2024 accounted for nearly half (49.6 per cent) of all streams, while eight out of ten (79.5 per cent) on-demand audio streams came from songs released after 2010.

Gen Z

The continuing emergence of Gen Z highlighted how different their music tastes were. For instance, Rihanna was their favourite singer, not Swift.

2024 marked the first time Gen Z topped other generations in overall live event spend. It was an average of $75 per month, with a preference for festivals. In Q2 2024, they spent 23 per cent more than the average American music listener.

Luminate forecast that EDM, Afrobeats and Indie Rock events will continue to flourish.

Millennials still had the highest monthly spend on individual concerts at $38 compared to $32 for the average music consumer.

Another trend carrying on through 2024 was the emergence of domestic music. "English-speaking markets are losing local share to non-English language imports," the report stated, "while many non-English speaking markets show local content gaining share."

Luminate showed that the rate of Australians taking out music streaming subscriptions was around 5 per cent, slightly higher than the USA’s.

But that’s miniscule compared to the free-to-paying rate of emerging music markets such as Turkey (up 17.8 per cent), Croatia (16.1 per cent), Romania (15.7 per cent), Malaysia (14.7 per cent) and South Korea (14.7 per cent). Also rising in double digits were Slovakia, Japan (which took its time moving from CDs to digital), Hungary, Greece and Hong Kong.

Superfans

Superfans continued to play a more critical role in live concerts and physical merchandise sales. They spent $113 a month on live music events (66 per cent more than the average musicgoer). They also dolled out $39 on physical purchases, 105 per cent more than the average. Seven out of ten will buy merchandise, rising to eight out of ten for Rock superfans.

According to Luminate, the growing popularity of the CD format is attributed to fans of K-Pop superfans because of the collectability value of small silver discs. Seven of the Top 10 selling CDs were by K-Pop acts.

The greater interaction between fans and acts was shown by how Direct-to-Consumer (D2C) music sales made up 63 per cent of first-week physical album sales in 2024 and 31.9 per cent of first-week total album activity.

Pop Dominance

Pop’s dominance was measured by the six women who dominated that style’s streams in the US. They were Taylor Swift with 12.8 billion streams, Billie Eilish with 4.46 billion, Sabrina Carpenter with 3.71 billion, Ariana Grande with 3.12 billion, Olivia Rodrigo with 2.76 billion and Chappell Roan with 2.49 billion.

The report conveyed, “Since Luminate began electronically tracking music consumption in 1991, Swift is the first artist to have three different albums be Luminate’s year-end No. 1.

“Adele is the only other act to have the year-end top album in three different years, but Adele did it with two albums: 21 (2011-12) and 25 (2015).”

Swift’s Tortured Poets’ ker-ching of 3.491 million copies on all formats made it the highest-selling album of any calendar year in the US since 2015, when Adele’s 25 sold 7.441 million copies. Poets’ sales were so big that it outsold the #2 to #8 best sellers combined.

R&B/hip-hop remained the most streamed genre, accounting for one in every four US streams (341.63 billion).

Rock had 234.22 billion streams and continued to dominate deep catalogue listening, with 72.6 per cent of its streams coming from tracks released more than five years ago.

Australia was among the three main territories where country music rose in popularity (alongside the UK and Canada) while Aussie Gen Zers and Millennials were behind the rise of Christian/gospel. Worldwide, the two age groups made up 45 per cent of its listeners compared to 39 per cent in 2022.

New Tracks

Luminate 2024 figures showed that 202 million new tracks were uploaded onto streaming services, up 9.8 per cent from 184 million the year before. That’s over a million new tracks each month.

However, Music Business Weekly, when covering the report, noted that almost half (93.2 million) of these new tracks were played no more than 10 times each last year.

There is an argument that these 93 million should, therefore, not be included in the royalty pool on streaming services from which artists are paid royalties. Spotify made the move last year by bouncing tracks with less than 1,000 plays from the pool.

“Luminate’s new numbers show that last year, some 175.5 million tracks were played 1,000 times or less across multiple audio streaming services, including Spotify,” MBW said. “That’s approximately 87 per cent of the 202 million tracks monitored by Luminate.”